Collin Crowdfund

Your expert partner in future-proofing yourbusiness to optimize and improve

Business Challenges

• A financing shortage for SMEs

• Finding investors

• Lack of an efficient and safe crowdfunding platform

Keys to Success

• With the help of low-code, a new platform, "digital mini-bank", was developed

• Built according to the rules of the Financial Markets Authority

• Personal credit rating system

Results

• Over 55,000 users and more than €1,2 billion successfully invested

• 99.8% of loans fully funded

• Built in less than 7 months

.png)

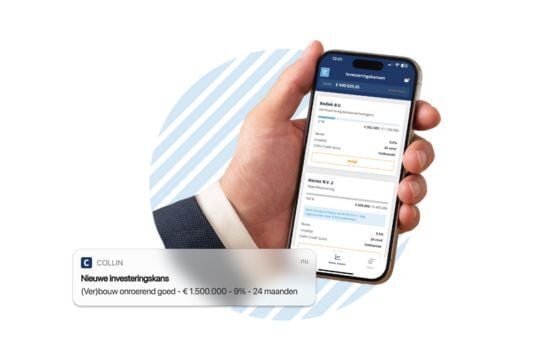

Case study Collin Crowdfund

The Dutch financial service provider Collin Crowdfund connects entrepreneurs and investors on its crowdfunding platform. This gives these entrepreneurs the chance to grow further with financing. Collin Crowdfund has turned to Emixa to build the platform using low-code technology. The innovative platform now offers creditworthy small and medium-sized enterprises non-traditional growth financing, while giving investors the chance to achieve an attractive return.

Business Challenges

Keys to Success

Results

The platform is the beating heart of our company

We chose Emixa because we were looking for a solution that would allow us to achieve fast time-to-market and be assured of quality. There was no off-the-shelf solution available, and customising an existing product would be more expensive and time-consuming than building a new platform with low-code. We now adapt our platform every six weeks with innovations and improvements based on feedback from our customers, which would not be possible with a standard solution.

Bram ter Huurne

Information Manager

Explore our Portfolio

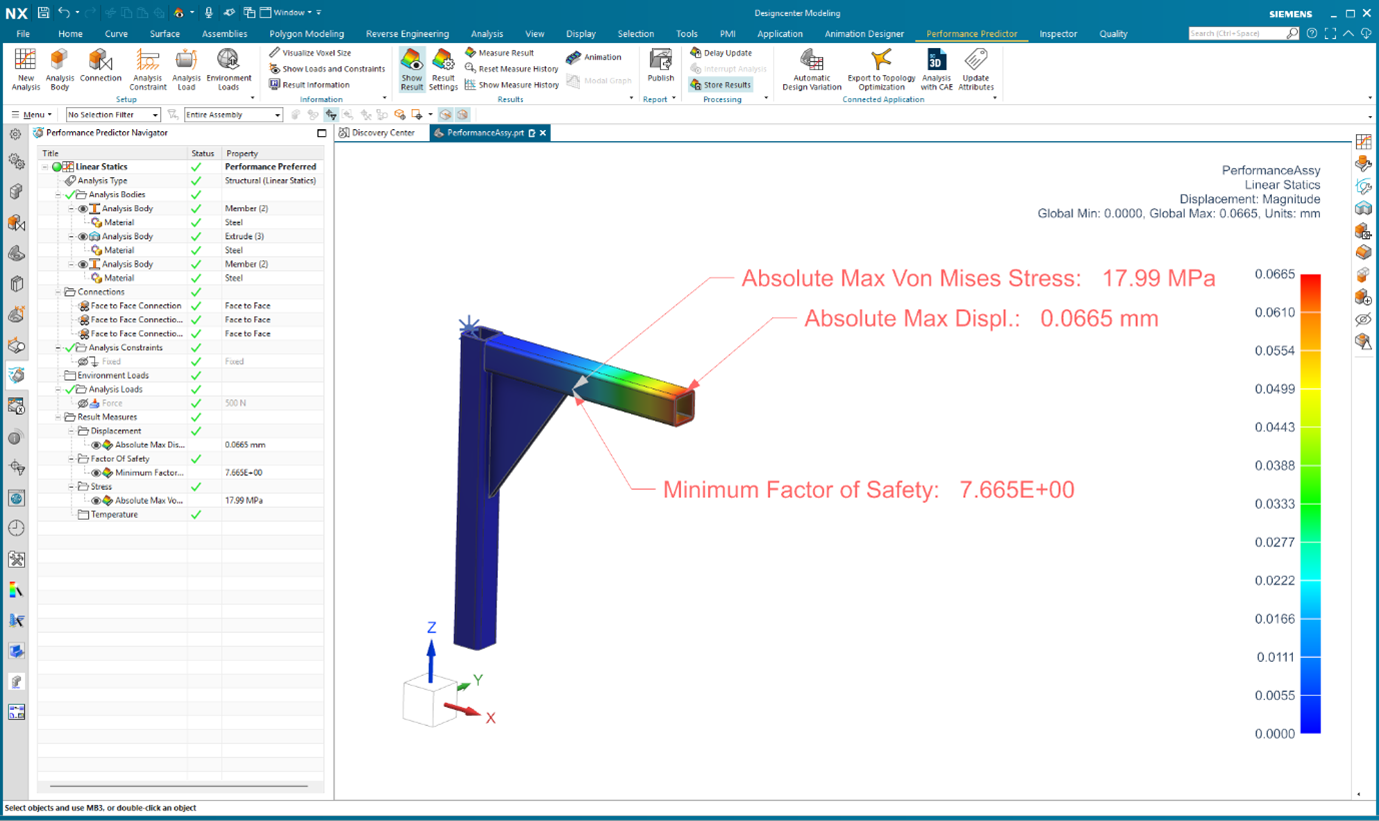

Product Lifecycle Management

Our PLM practice powers industry innovation through design, simulation, manufacturing, and effective project management in the manufacturing industry.

Enterprise Resource Planning

Our ERP practice leverages SAP solutions to enhance efficiency, streamline supply chains, and improve resource management in the manufacturing industry.

Applications

Our specialist practice for the manufacturing industry creates tailored solutions to drive innovation and streamline operations using Mendix-based applications.

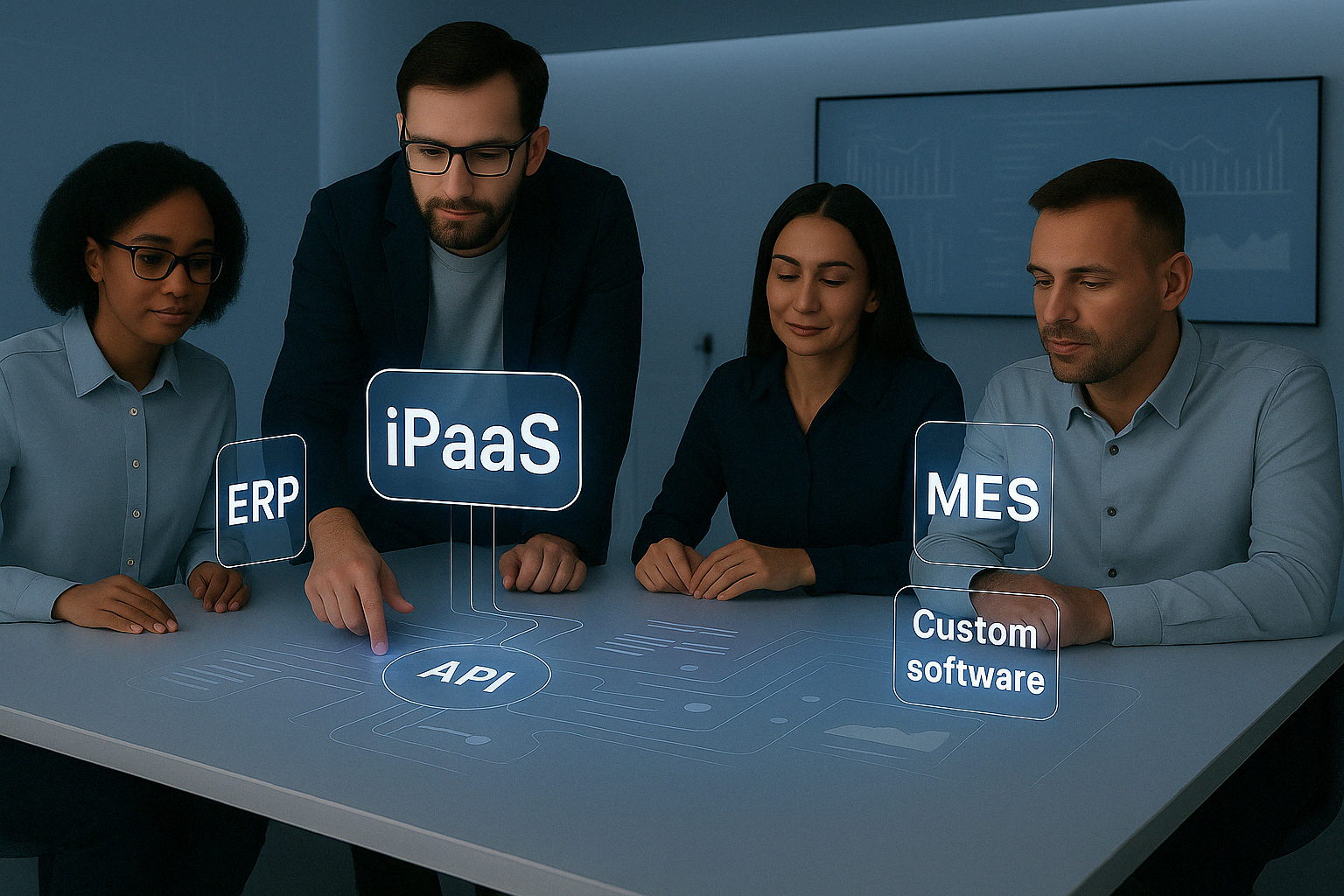

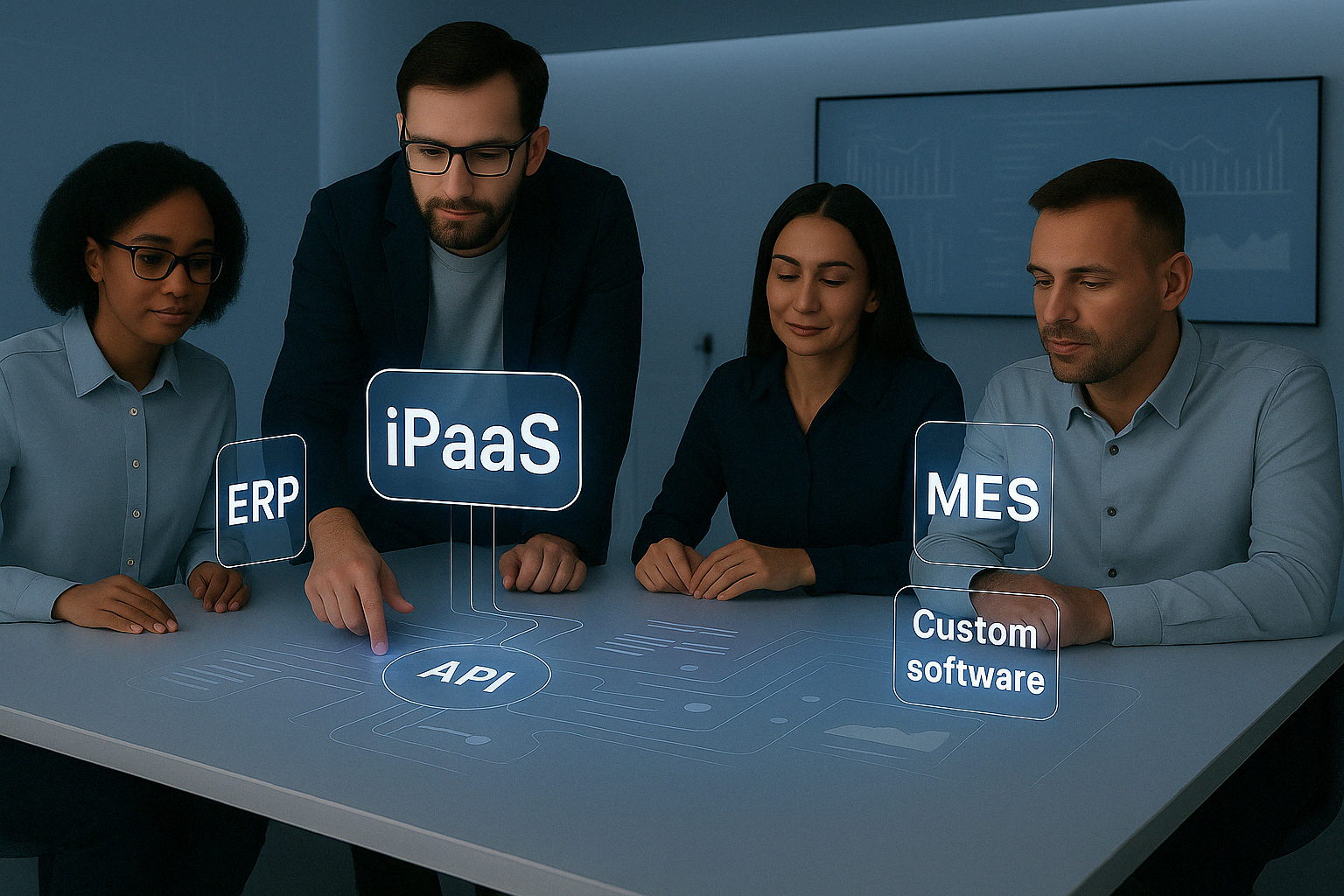

Integrations

Our specialist practice uses Boomi integrations to ensure smooth connectivity and data integration for improved operations in the manufacturing industry.

Data & Analytics

Expertise in Data Analytics tailors BI & AI strategy, data science, engineering, IoT platforms, ESG reporting, and financial analytics in the manufacturing industry.

Management Consulting

Management Consulting offers strategic guidance in the manufacturing industry, fostering digital transformation and operational improvement.

Product Lifecycle Management

Our PLM practice powers industry innovation through design, simulation, manufacturing, and effective project management in the manufacturing industry.

Enterprise Resource Planning

Our ERP practice leverages SAP solutions to enhance efficiency, streamline supply chains, and improve resource management in the manufacturing industry.

Applications

Our specialist practice for the manufacturing industry creates tailored solutions to drive innovation and streamline operations using Mendix-based applications.

Integrations

Our specialist practice uses Boomi integrations to ensure smooth connectivity and data integration for improved operations in the manufacturing industry.